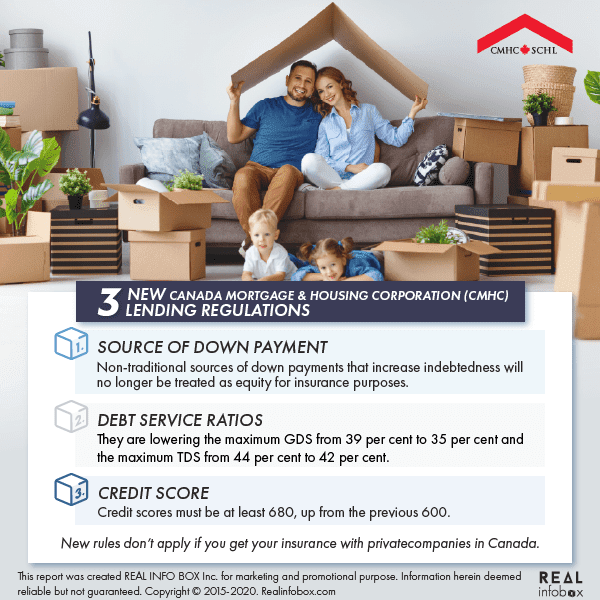

Three new Canada Mortgage & Housing Corporation (CMHC) lending regulations went into effect July 1, 2020. Note, these might not affect you if you get mortgage insurance from private companies, rather than from CHMC.

Source of Down Payment

CMHC says: Non-traditional sources of down payments that increase indebtedness will no longer be treated as equity for insurance purposes.

What it means: CMHC will no longer allow you to use borrowed funds for your down payment.

Debt Service Ratios

CMHC says: (We’re) lowering the maximum GDS from 39 per cent to 35 per cent and the maximum TDS from 44 per cent to 42 per cent.

What it means: Gross Debt Service ratio (GDS) is the share of income used to cover a mortgage + other housing costs like property taxes. Total Debt Service ratio (TDS) is the share of income used to cover housing costs + cost of servicing other debts. With a 39 per cent GDS (previously), a family with $100K income and 10 percent down would have qualified to buy a $524,980 home. Under the new rules, that same family would only be approved to buy a $462,860 home, a reduction of 12 percent.

Credit Score

CMHC says: Credit scores must be at least 680, up from the previous 600.

What it means: Would-be homebuyers' qualifying credit scores must be at least 680, up from the previous 600.

Not sure you’ll meet the new CMHC requirements? As mentioned, you might still be OK. As of this writing, the rules don’t apply if you get your insurance with private companies such as Genworth MI Canada Inc. and Canada Guaranty Mortgage Insurance Co.

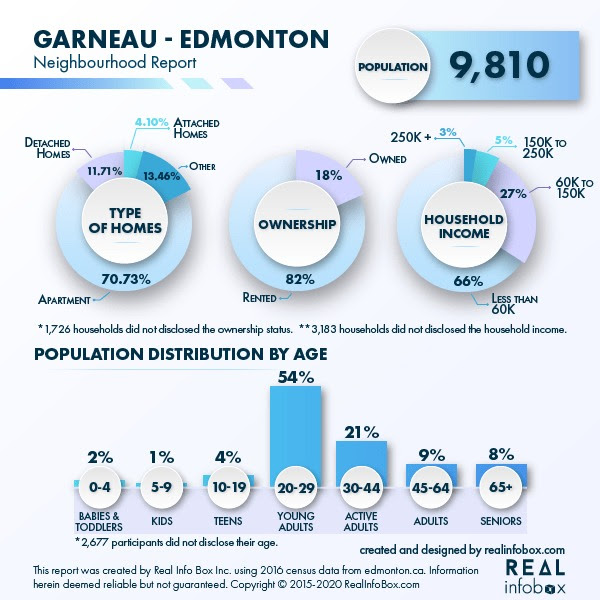

The Garneau area of Edmonton has been described as “melting into the University of Alberta grounds” that border it.

The busy High Level Bridge connects it to downtown Edmonton. The LRT and major city bus routes run right through the neighbourhood, whisking you quickly to Whyte Avenue and 109 Street for shopping.

And this leafy, mature treed community, one of Edmonton’s oldest, also has one of its most diverse and funky assortments of coffee shops, restaurants and craft beer pubs anywhere in Alberta!

Looking for a property here? You’re not alone, although the majority of the community’s inhabitants are actually renters, living in character houses or walk-up apartments. If you’re buying, you can choose between new condo towers or one of the many 1950s era houses. Whatever you choose, you’ll benefit from the neighbourhood’s good schools, access to the University of Alberta Hospital and proximity to the river valley for world class scenery and recreation.

|

Comments:

Post Your Comment: